The Financial Planning Process

The Financial Planning process visually shows you how we develop your plan

step by step to improve the direction of your finances.

Frequently, as a result, our clients are set up to build and retain more wealth

– which enables them to reach financial independence sooner.

The Financial Plan makes you ask yourself some questions

Financial Independence can differ depending on what is important to you.

These are some of the questions that you need to ask before we finalise your plan.

Once the plan is set up and implemented, we will meet annually to measure

if the plan is on track and update it with any changes

to your circumstances, goals/objectives.

The Financial Plan – Step by Step

1. Discovery

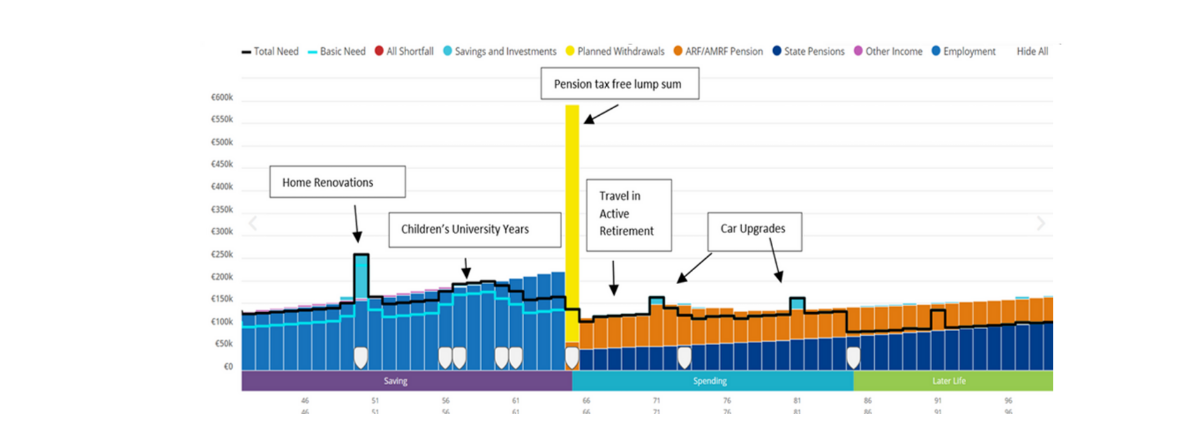

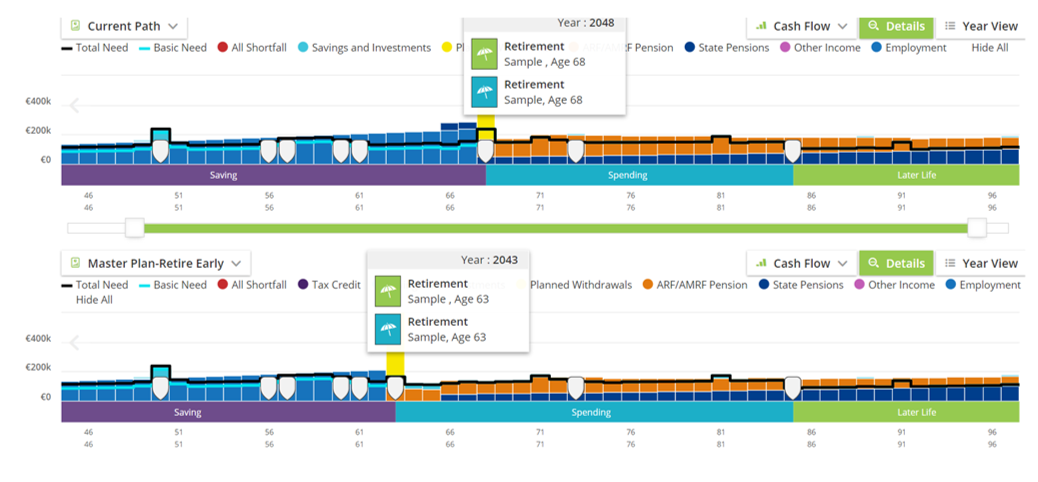

You complete a short Financial Questionnaire. Then we meet to begin to map out your current financial direction. We ask you to consider the aims and goals that you want to achieve over the years ahead and we build you plan out until age 100. By the end of our first meeting, we will tell you at what point you will reach financial independence by continuing to do as you are currently doing.

2. Analysis and interpretation

We begin to further understand your financial circumstances by obtaining up to date details of your pensions, investments and life policies, to see if these are currently aligned to the goals you have advised to us. We then meet again to present our findings and consider whether actions need to be taken and to ensure that you are satisfied with our interpretation of your goals.

3. implementation of plan

We then issue the written plan to you. You review the plan and have some time to digest the steps involved. We then meet to discuss the implementation of your plan to include any changes that may be required to your current strategy.

4. progress meetings

Once your financial plan is in place, we ensure that the plan stays on track for you to reach your goals and objectives. The annual review is an opportunity to check in and update your plan with any changes & progress made.

The Financial Plan includes

We help you reach Financial Independence so that you can comfortably retire knowing that your financial future is secure

Aligning your investments to your current risk profile to ensure that you are on the most suitable investment strategy to reach your goals and objectives

Review your existing cover to see if you have too much or too little cover in place to protect against illness, disability or death

We help you plan the transfer of wealth to your loved ones, tax efficiently

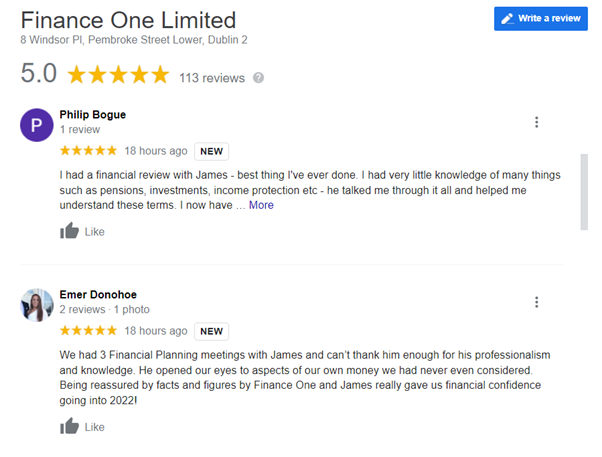

Meet James Kane – Our Head of Financial Planning

A Certified Financial Planner, James is our lead in creating Financial Plans for our customers.

James gets a great kick out of improving people’s financial position and outlook.

“It’s a great feeling to know that I

can make my clients more confident

and relaxed about their finances.”

“I recently worked with a couple who

were spending a lot of money on

short-term debt, but didn’t have any

long-term savings plans.

Their current direction had them

reaching retirement in their 70s,

but now they are projected to reach

retirement by age 69”

What Does it Cost to Make a Financial Plan with Finance One?

The cost of having Finance One work with you to create your customised Financial Plan is €750 plus VAT.

This reflects the time, expertise and use of planning software tools that it takes to devise a strategy that can have a dramatic impact on your financial outlook.